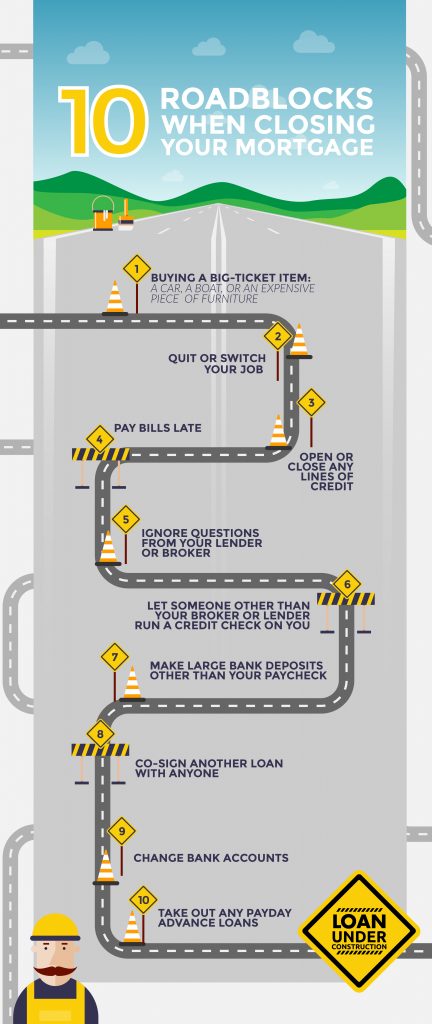

Congratulations! You’ve found your dream home and applied for a mortgage through the Indianapolis mortgage broker company, Grandview Lending. But before you start celebrating, you need to remember that your loan is still under construction. What that means is, you need to stay on course to make sure your mortgage approval process goes smoothly. Otherwise, if you take a wrong turn, a roadblock may occur that can slow down your mortgage process, or even possibly put the brakes on it all together.

Below are some potential obstructions you should avoid if you want your mortgage to make it to your destination – closing.

Let’s talk about each of these 10 roadblocks in more depth. These are things you should not do while waiting for your mortgage to be approved.

1.Buy a Big-Ticket Item

While you may want to buy new furniture or appliances for your home before you move it, you need to wait. The same goes for a new car, boat, or another expensive item. Don’t buy anything until you have closed on your loan.

Why? A big purchase can affect your debt-to-income ratio – or, in other words, how much you owe monthly on debts compared to your pre-tax earnings. Your debt-to-income ratio affects the maximum loan amount you qualify for. If you make a big purchase, your loan amount could be lowered – meaning if the home you’re buying is more than the adjusted loan amount, you won’t be able to purchase your dream home.

2. Quit or Switch Your Job

Making any career changes before your mortgage closes may hurt your chances of getting a mortgage or delay the mortgage process. Your lender wants to make sure you have a steady, reliable source of income and that you can pay your monthly mortgage. Any income adjustments could change your approved mortgage amount. Even if you’re taking a job that earns more money, it’s best to wait since income verification is a major step in the loan process.

3. Open or Close any Lines of Credit

When you open or close a line of credit, it affects your credit score. Doing either will likely result in a lower score. This, in turn, affects the mortgage amount you qualify for. Therefore, wait until you’re in your new home before you open or close any credit accounts.

4. Pay Bills Late

Since your credit score matters to your lender, you don’t want to do anything to potentially hurt your score – and that includes missing bill payment deadlines. Paying even one bill late can knock around 100 points off your credit score. Plus, if you can’t pay your bills on time, your lender may assume you’ll pay your mortgage payments late, too.

5. Ignore Questions from Your Lender or Broker

If your lender or broker asks questions or requests something specific, don’t ignore them. Answer their questions and provide them with all documents as soon as possible. Otherwise, your mortgage process may be delayed.

6. Let Someone Other than Your Broker or Lender Run a Credit Check on You

First, a credit check will take points off your credit score, which affects your mortgage amount. Second, when someone runs a credit check, your lender may assume you’re getting ready to open a new credit account. They may worry you will make purchases on this account, which will affect your ability to repay your mortgage loan. Also, all credit checks must be verified, which could delay your closing.

7. Make Large Bank Deposits Other than Your Paycheck

Your lender needs to know where your income is coming from. All large bank deposits other than your usual paycheck must be verified with complete documentation. If you receive gift funds, you will need to provide your lender with a gift letter from the person who gave you the money.

8. Co-sign Another Loan with Anyone

When you co-sign a loan, you’re assuming liability for someone else’s debt. If that person stops making loan payments, you’re required to make the payments instead. Therefore, this amount is included in your debt-to-income ratio calculations, which affects your qualified loan amount.

9. Change Bank Accounts

Your lender will review your bank accounts during the loan pre-approval process and the underwriting process. Any unusual deposits or withdrawals will require documentation to explain the movement of these funds.

10. Take Out any Pay Day Advance Loans

While a pay day loan usually doesn’t affect your credit score, it can still make it more difficult to get a mortgage. If you were to default on the loan, the pay day lender may send the debt to a collections agency, which will likely cause the loan to show up on your credit report. Since pay day loans often have exorbitant interest rates, the likelihood for defaulting can be very high. Therefore, avoid the possibility of default by passing up pay day loans all together.

When you steer clear of these roadblocks along your path, you’re more likely to have a smooth ride toward closing.

What Do I Do if I Hit a Roadblock?

If any of these roadblocks occur during your loan process, contact your Grandview Lending broker at 317-255-0062 as soon as possible to determine what needs to be done next.

How Do I Start the Loan Process with Grandview Lending?

If you’re interested in purchasing a home and getting a mortgage loan, contact the mortgage experts at Grandview Lending. Or, begin by completing and submitting our loan application form. They’ll be happy to provide you with answers and guide you every step of the way through the loan process.

Stay on the right path to homeownership with Grandview Lending by your side.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Today's Mortgage Rates

Leave a Reply