Down Payment Insurance: Confidently Buy Your Home

November 27th, 2017

November 27th, 2017

Photo credit: iStock Photo / Kuzma

Buying a home is a big investment for most buyers. As a part of that investment, you’re often required to put down a down payment on your new home. But what happens if you need to move within 2 to 7 years? More than likely, you would lose your hard-earned assets. But with PacificPlus Down Payment Insurance Protection, that’s not the case.

Sometimes, life events happen outside of your control that can impact your home. You could be forced into a situation where you could lose the down payment investment you made on your home.

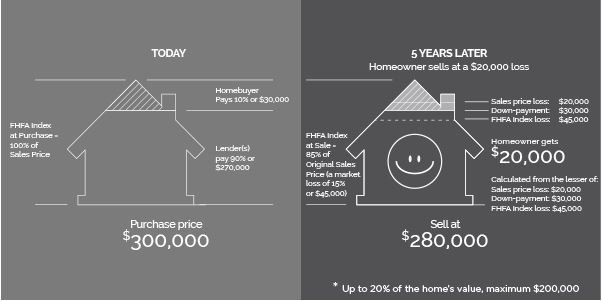

PacificPlus Down Payment Insurance Protection is insurance that protects your down payment – even if you must sell your home in a declining real estate market and move. The program covers your down payment costs (up to 20% of your home’s value or a maximum of $200,000). Once all program requirements are met, you’ll be reimbursed for any potential losses.

With PacificPlus down payment insurance, you don’t have to worry about losing your nest egg or your retirement savings if you’re an investor. You’ll have peace of mind, knowing you’re protected.

PacificPlus Down Payment Insurance Protection works like an insurance policy to protect you from unforeseen life changes that may require you sell your new home and move. These life events can include a career move, a new baby, an elderly parent who must move in with you, or more.

For example, let’s say you’re a potential home buyer, but your job requires you to move frequently. You’d love to buy house, but you’re afraid your career will require you to move within a few years, causing you to lose your down payment investment.

By purchasing PacificPlus Down Payment Insurance Protection, you can go ahead and buy a home, knowing your down payment is protected.

Therefore, you purchase a home and put down $20,000 as a down payment. Five years later, you receive a promotion that requires you to relocate to another city. Unfortunately, the real estate market is down, forcing you to sell your home for less money than you paid. Without PacificPlus protection, you could have lost your $20,000 down payment. But since you have PacificPlus, you’re reimbursed your $20,000.

It’s really that simple!

PacificPlus Down Payment Insurance Protection is available as a feature on the following Pacific Union loan products:

Some additional facts about PacificPlus Down Payment Insurance Protection you should know:

If you’re interested in learning more about PacificPlus Down Payment Insurance Protection, contact the mortgage specialists at Grandview Lending in Indianapolis. We want to make the mortgage experience easy for our customers while helping them to protect their down payment investment. With the right tools, you can make the best financial decision for your individual situation – and gain back control when life’s unexpected occurrences happen. Call us today at 317-255-0647.

We provide our clients with exceptional service and integrity which has become our hallmark.