Interest Rates Are Still Low. Time to Buy a Home?

October 24th, 2017

October 24th, 2017

Photo credit: iStock / Devonyu

Got your eye on a charming two-bedroom bungalow? Or, maybe a four-bedroom French colonial with an updated kitchen is more your style.

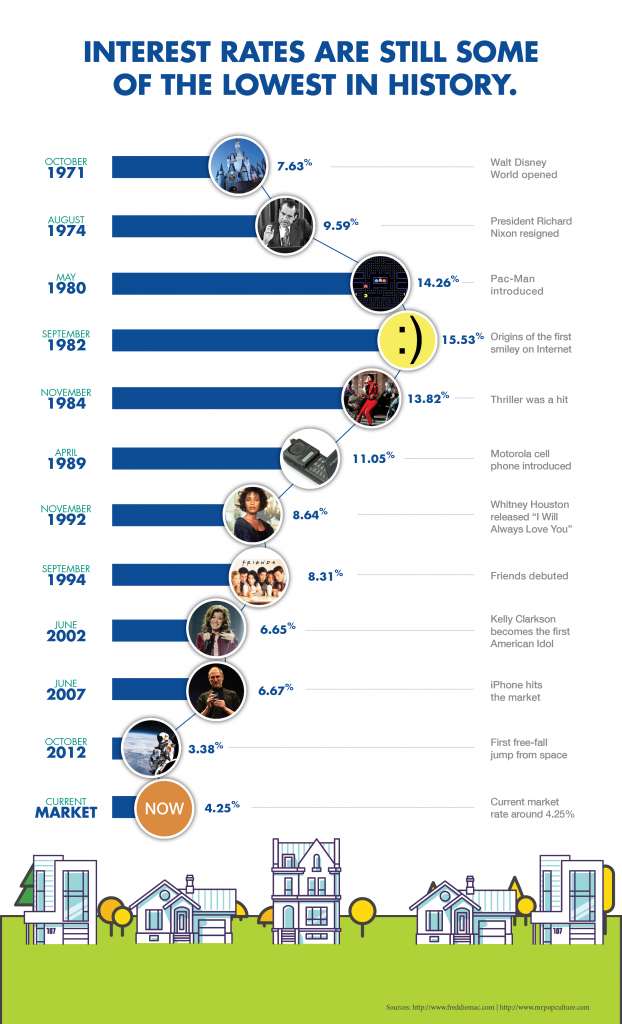

No matter what style of home you love, if you’re ready to buy, now is the time to act. Although interest rates are slightly higher than five years ago, they’re still on the low end when you compare them over the past 45+ years. Look at the infographic below to see what we mean.

As you can see interest rates are lower than they’ve been over the years, but that doesn’t mean they’ll stay that way forever. It’s not unreasonable to expect them to go up in the near future. But why is that? There are several factors that affect mortgage interest rates:

As inflation causes overall prices to increase, it decreases how much you can buy over time. Mortgage lenders maintain interest rates in comparison to inflation to make sure their interest returns on loans provide them with a real net profit.

Mortgages rates are also influenced by economic growth indicators, like the gross domestic product (GDP) and the employment rate. When we have higher economic growth, generally, people have higher incomes and are spending more, including buying homes. With a higher demand for mortgages, interest rates tend to rise. Naturally, the opposite applies in a weak economy. Employment and wages decline, spending habits decrease, the demand for home loans is reduced, and, consequently, interest rates are lower.

While the Federal Reserve doesn’t set mortgage interest rates, it does establish the Fed Funds rate and adjusts the money supply upward or downward. It’s these actions that have an impact on interest rates. Generally, increases in the money supply cause rates to go downward, while a tightened money supply results in higher rates.

Banks and other investment firms offer mortgage-backed securities (MBSs) as investment products. MBSs are loans with similar characteristics like credit score, term length and equity amount that are packaged together. Mortgage bonds enable lenders to make money now instead of waiting 30 years, so they can continue to make loans to other people. However, MBSs have an impact on mortgage rates. When mortgage rates are down, people are more likely to buy MBSs. But when the economy is doing well, people are more likely to sell their mortgage bonds and put their money in the stock market. Therefore, to attract more investors in MBSs, mortgage rates need to be higher.

Mortgage rates are affected by trends and conditions in the housing market. If fewer homes are being built or put on the market for resale, less homes are being purchased which pushes down demand for mortgages and reduces interest rates.

If interest rates were to rise, that means you would pay more in interest over the years, which could equal a substantial chuck of change depending upon your loan amount. Therefore, to save money, it makes sense (and cents) to purchase a home while interest rates are low.

If you’re ready to shop for a new Indianapolis-area home, contact Grandview Lending to get preapproved for a mortgage loan. We know some of this interest rate stuff and mortgage process can be hard to understand, so don’t hesitate to ask questions. Our mortgage experts will be happy to provide you with answers and help you through the process of obtaining the right mortgage loan for your situation. Call us today at 317-255-0062.

We provide our clients with exceptional service and integrity which has become our hallmark.