Certain VA Funding Fees and FHA MIP Reduced

May 22nd, 2023

May 22nd, 2023

Are you thinking about applying for a VA or FHA loan? In both cases, you will be pleased to learn that these types of mortgages are more affordable than ever thanks to reductions in FHA MIP and certain VA funding fees.

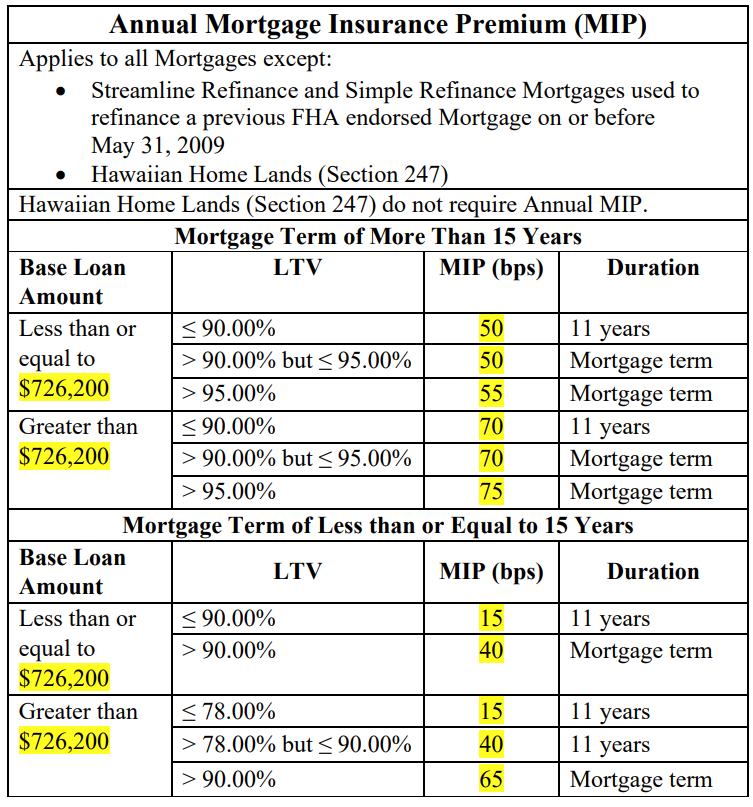

The monthly mortgage insurance premiums (MIP) for FHA mortgages are decreasing by 30 bps as of March 20th, 2023.

This change is going to impact a huge number of homebuyers. It is estimated that over the next year alone, around 850,000 people will end up saving a total of $678 million put together.

HUD explains, “For the same borrower with a mortgage of $467,700 – the national median home price as of December 2022 – FHA’s annual MIP reduction will save them more than $1,400 in the first year of their mortgage. In addition to providing overall savings to borrowers, a lower annual MIP can also help more people qualify for a mortgage.”

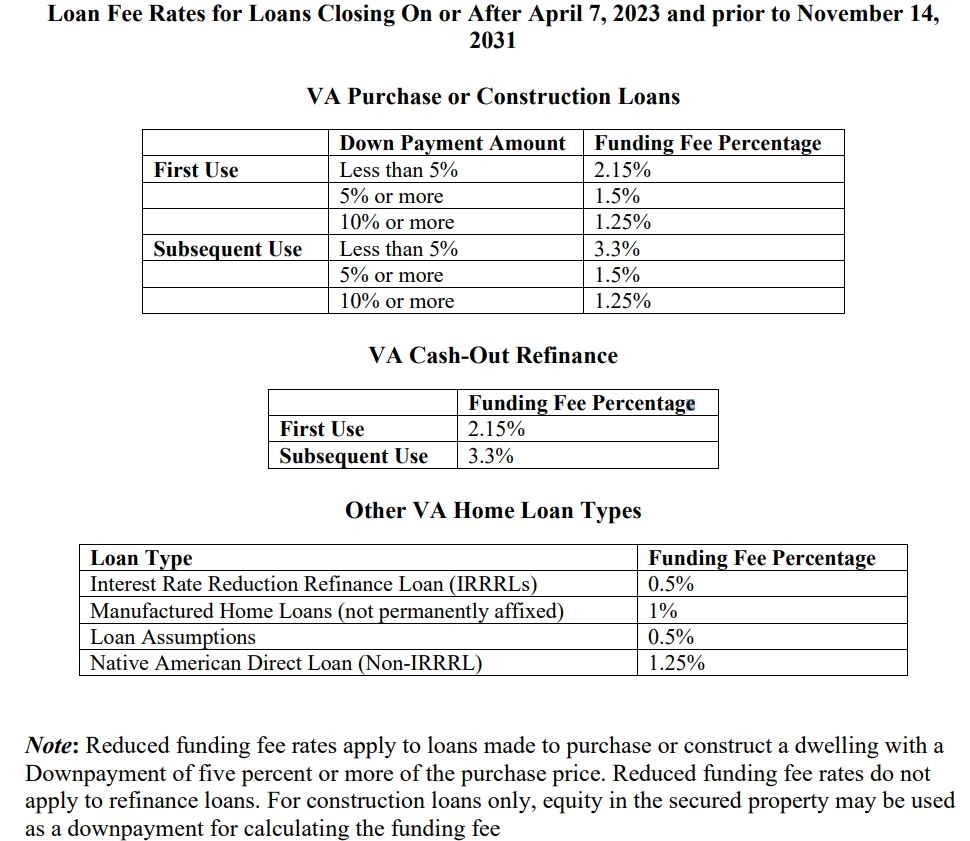

Along with the changes discussed above for FHA MIP, funding fees for certain VA mortgage are also being reduced. This change affects mortgages that close on or after April 7th, 2023 and before November 14th, 2031.

You must be making a down payment of 5% or more for the reduced funding fees to apply. Your mortgage also must be for home purchase or construction. You cannot take advantage of these reduced fees if you are refinancing.

Whether you are in Indianapolis or anywhere in IN, we can help you apply quickly and easily for an FHA or VA mortgage. To begin, please give us a call today at (317) 255-0062 to schedule your mortgage consultation.

We provide our clients with exceptional service and integrity which has become our hallmark.