Does Your Type of Home Loan Require Mortgage Insurance?

December 8th, 2018

December 8th, 2018

Are you in the process of getting a new home mortgage or refinancing an existing mortgage? While checking out various types of loans, you may discover that you’re required to pay mortgage insurance. You may wonder why some lenders require this type of insurance? Below are some answers to your questions.

Often, most home buyers have difficulty saving enough money for a down payment on a home. Mortgage insurance enables you to buy a home with a smaller down payment than what otherwise may be required.

Typically, lenders require mortgage insurance for loans with down payments of less than 20% of the home’s purchase price. This type of insurance protects your lender – not you – should you fall behind on your mortgage payments and go into foreclosure. This financial guaranty enables lenders to accept a smaller down payment when giving you a home loan.

Several different kinds of loans are available to borrowers with low down payments that require mortgage insurance.

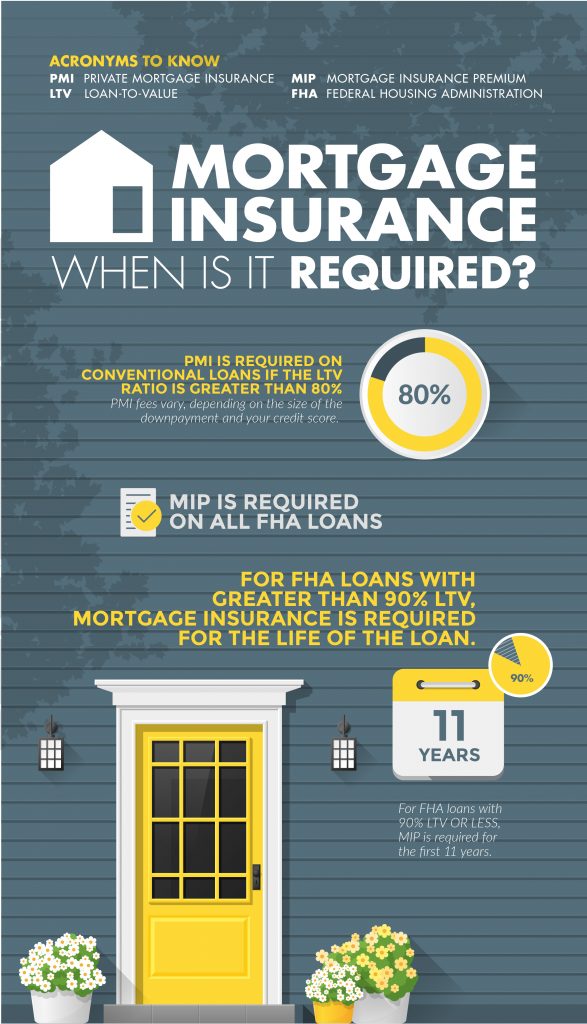

For conventional loans, private mortgage insurance or PMI is arranged by your lender and provided by private insurance companies. If you’re buying a home, PMI is required on a conventional loan with a down payment of less than 20%. If you’re refinancing your home with conventional loan and your equity is less than 20% of the value of your home, you’ll also be required to pay PMI.

Typically, you’ll pay PMI premiums until you have enough equity in your home to have a loan-to-value ratio (LTV) of 80%. LTV is the amount of money you borrowed divided by the value of your home.

PMI rates vary depending upon your down payment amount and your credit score. For a conventional loan with PMI, you’re required to have little or no payment at closing. And you’ll pay your insurance premiums monthly. You may cancel your PMI under certain circumstances.

If you’re getting an FHA mortgage, mortgage insurance premiums (MIP) are mandatory on all FHA loans, regardless of the size of your down payment.

For FHA loans with more than 90% LTV, you’ll have to pay mortgage insurance for the life of your loan. For FHA loans with 90% LTV or less, you’re only required to pay MIP for the first 11 years.

MIP rates are the same no matter your credit score. However, you may see a slight price increase if your down payment is less than 5%. Not only will you have a monthly MIP cost to pay, you’ll also have an upfront cost that’s paid as part of your closing costs. However, you can roll the upfront insurance premium cost into your mortgage.

The USDA doesn’t require you to make a down payment on USDA Rural Housing loans. Therefore, to cover this risk, you’re required to pay mortgage insurance. Even if you make a down payment – regardless of the amount, you must pay for this insurance.

The mortgage insurance on USDA Rural Housing Loans is paid upfront as a Funding or Guarantee Fee at closing time. However, you do have the option to finance this fee into your home loan.

Additionally, you’ll also pay an annual fee that’s lumped into your monthly mortgage payments. You’ll have to pay this annual fee for the life of your home loan.

With a VA home loan, you’re not required to make a down payment. Additionally, you won’t have any monthly mortgage insurance payments. However, all veterans taking out a VA loan generally are required to pay an upfront funding fee. This funding fee is a percentage of your loan amount. The fee cost varies depending upon:

You can pay this funding fee in cash at closing time, or you can finance it into your mortgage.

For many borrowers, mortgage insurance is an essential part of home-buying costs. If you’re not sure which type of home loan is right for you – or if you may be required to pay mortgage insurance, contact one of the mortgage specialists at Grandview Lending, your mortgage broker in Indianapolis, at 317-255-0062. We can help you evaluate your options and explain how mortgage insurance may factor into your equation. We can also help you figure out how much you’ll have to pay in either upfront fees or as part of your monthly mortgage payment. By understanding all your loan options and any mortgage insurance costs, you can make the best home loan decision based on your needs.

If you are ready to begin, please contact us today at (317) 255-0062. We look forward to helping you finance your investment of land in Indiana.

We provide our clients with exceptional service and integrity which has become our hallmark.